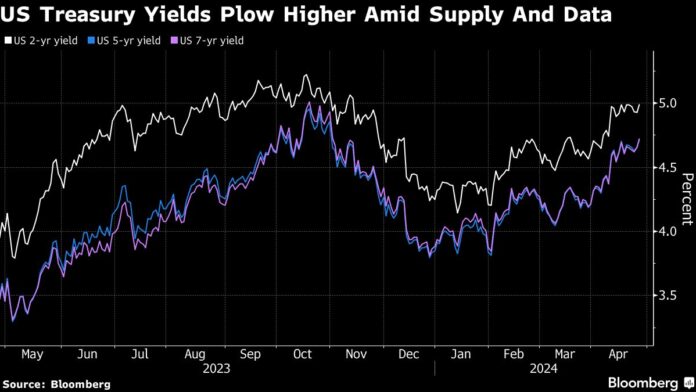

(Bloomberg) — Treasury yields rose to their highest levels in 2024 as evidence of sticky U.S. price pressures cast doubt on the Federal Reserve’s ability to start cutting interest rates later this year. Global bonds repeated the sell-off.

Most read from Bloomberg

Another major inflation report is due on Friday, with expectations of even a single rate cut this year likely to erode further. However, demand was fair to strong at this week’s more than $180 billion Treasury bond auctions, a sign that investors still tend to treat rising yields as buying opportunities.

“A lot of macro news is now embedded in the yield curve,” said Jorge Goncalves, head of US macro strategy at MUFG. Ahead of Friday’s inflation reading, followed by the Treasury’s recovery announcement and the Fed’s meeting next week, strong auction demand “shows that the market is efficient and not looking to overpay for US Treasuries yet.”

Read more: US yields rise as traders see Fed delaying first cut to December

US 10-year Treasury yields rose as much as nine basis points to 4.74% on Thursday before stabilizing on Friday. This move extended to Asia, with Australian, New Zealand and Japanese bonds declining.

Economic data released earlier on Thursday was the latest to force Wall Street to temper its expectations for lower borrowing costs in the world’s largest economy. GDP rose at an annual rate of 1.6% in the latest quarter, while the closely watched measure of core inflation advanced at a greater-than-expected 3.7% rate.

As a result, traders have trimmed their expectations on the timing of the Fed’s rate cut, with the first cut fully priced in December. They now see only about 33 basis points of Fed rate cuts throughout 2024, far less than the more than six-quarter-point cuts they expected at the start of the year.

“Inflation will end the year between 2.5% and 3.5%,” said Sinead Colton Grant, chief investment officer at Bank of New York Mellon.

Treasury yields remained higher during Thursday’s trading session as traders looked forward to more economic indicators on Friday. The Personal Consumption Expenditures Price Index – the Fed’s preferred measure of inflation – is expected to show that the annual rate rose to 2.6% last month, from 2.5% in February. This would signal a halt in progress toward the Fed’s 2% target.

Then US policymakers will meet next week and announce an updated policy statement. Attention will likely focus on any comment from Chairman Jerome Powell about the recent data and its implications for the price path going forward. In March, Fed officials set expectations for three-quarter point cuts in 2024. Employment data at the end of next week will also provide more clarity on the economy.

For Colton Grant of the Bank of New York, the “biggest risk” for investors is focusing on the number of interest rate cuts this year — and “missing the big prize, which is the ability to add better diversification to your portfolio at a higher return level.” “.

The yield on the benchmark two-year Treasury note rose to 5.02% before buyers entered on Thursday. Yields of more than 4.70% in 10 years also attracted buyers.

As yields rose, the Treasury was able to sell $44 billion worth of seven-year bonds in line with expectations, capping three auctions that flooded the market this week.

Overall, buyers seized on the Treasury sales without much fanfare. An auction for two-year notes found strong demand that forced the yield below the bidding deadline, and five-year notes arrived only slightly weak.

Meanwhile, the seven-year auction was awarded at a yield of 4.716%, the same level indicated in pre-auction trading at the 1pm New York time bidding deadline – an indication that demand is meeting traders’ expectations. Bond dealers subscribing to the seven-year auction have only 13.9% of notes left, below the recent average of 15.1%, according to BMO Capital Markets.

–With assistance from Liz Capo McCormick and Elizabeth Stanton.

(Adds global bond movements.)

Most read from Bloomberg Businessweek

©2024 Bloomberg L.P

#bonds #lead #global #selloff #fixed #rates #influence #Feds #path